Price-to-Earnings (P/E) Ratio

PE ratio is the ratio of a company’s stock price to its earnings per share. Value investors commonly use it as one way to measure if a company is undervalued.

Calculating the P/E Ratio

To calculate a company’s P/E ratio, we use the following formula:

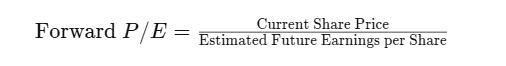

| COMPANY (Sample data) | STOCK PRICE (P/S) | Diluted EARNINGS PER SHARE (EPS) | PRICE-to-EARNINGS (P/E) Ratio |

|---|---|---|---|

| Company AA | 106.94 | 6.31 | 106.94/6.31 = 16.95 |

| Company BA | 150.91 | 9.76 | 150.91/9.76 = 15.46 |

| Company CA | 79.95 | 3.71 | 79.95/3.71 = 21.55 |

| Company DA | 178.35 | 7.54 | 178.35/7.54 = 23.66 |

EARNINGS PER SHARE (EPS):

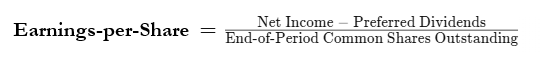

Earnings per share (EPS) is a company’s net income subtracted by preferred dividends and then divided by the number of common shares it has outstanding.

Calculating Earnings per Share:

Forward Price-to-Earnings (Forward P/E)

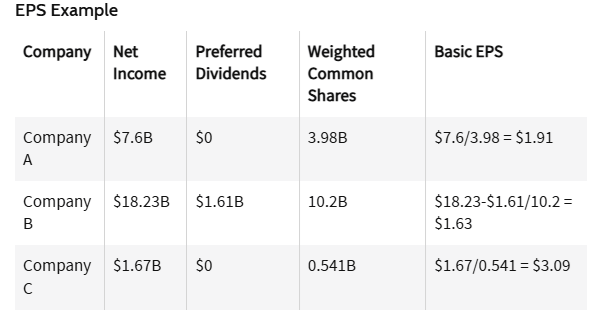

Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings to calculate the ratio.

Calculating Forward P/E Ratio:

For example, assume a company has a current share price of $50 and this year’s earnings per share (EPS) are $5. Analysts estimate that the company’s earnings will grow by 10% over the next fiscal year. The company has a current P/E ratio of:

The forward P/E, on the other hand, would be $50 / (5 x 1.10) = 9.1x. Note that the forward P/E is smaller than the current P/E since the forward P/E accounts for future earnings growth relative to today’s share price.

Trailing Price-To-Earnings (Trailing P/E)

Trailing price-to-earnings (P/E) is a relative valuation multiple that is based on the last 12 months of actual earnings. It is calculated by taking the current stock price and dividing it by the trailing earnings per share (EPS) for the past 12 months.

Trailing P/E can be contrasted with the forward P/E, which instead uses projected future earnings to calculate the price-to-earnings ratio.

Calculating Trailing P/E Ratio:

Trailing P/E Ratio = Current Share Price / Trailing 12-Month EPS

Example of Trailing Price-To-Earnings

For example, a company with a stock price of $50 and 12 month trailing EPS of $2, thus has a trailing P/E ratio of 25x (read 25 times). This means that the company’s stock is trading at 25x its trailing 12 month earnings.

Using the same example, if the company’s stock price falls to $40 midway through the year, the new P/E ratio is 20x, which means the stock’s price is now trading at only 20x its earnings. Earnings have not changed, but the stock’s price has dropped.

| Company (Sample data) | Current Share Price (P/S) | Est. Future EPS (12 months) | Forward P/E | Trailing EPS (12 months) | Trailing P/E (x is read x times) |

| Company AAS | 50 | 5 X 10% | 50 / (5 x 1.10) = 9.1 | 2 | 50 / 2 = 25x |

| Company ABS | 65 | 6.5 X 20% | 65 / (6.5 x 1.20) = 8.33 | 4 | 65 / 4 = 16.25x |

| Company ACS | 205 | 3.5 X 30% | 205 / (3.5 x 1.30) = 45.06 | 4 | 205 / 4 = 51.25x |