What Is a Good PEG Ratio for a Stock?

The price/earnings-to-growth ratio, or PEG ratio, divides a company’s price-to-earnings (P/E) ratio by its earnings growth rate over a specific period. It strengthens the P/E ratio by taking into consideration the growth rate of earnings.

The PEG ratio is a stock valuation measure that investors and analysts can use to get a broad assessment of a company’s performance and to evaluate investment risk.

In theory, a PEG ratio value of 1 represents a perfect correlation between the company’s market value and its projected earnings growth. PEG ratios higher than 1.0 are generally considered unfavorable, suggesting a stock is overvalued. Conversely, ratios lower than 1.0 are considered better, indicating a stock is undervalued.

Key Takeaways

- The price/earnings-to-growth, or PEG ratio is a valuation metric used for stocks.

- PEG builds on the P/E ratio by considering expected earnings growth and not just current earnings.

- A PEG ratio of under 1.0 can indicate a stock is undervalued and a potential buy.

- A PEG above 1.0 can indicate an overvalued stock.

- The PEG will vary based on earnings growth forecasts and the time frame being considered.

Calculating the PEG Ratio

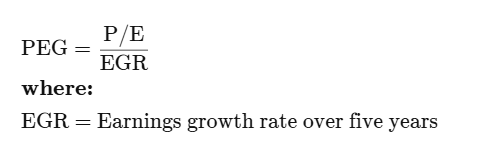

To calculate a stock’s PEG ratio you must first figure out its P/E ratio. The P/E ratio is calculated by dividing the per-share market value by its per-share earnings. From here, the formula for the PEG ratio is simple:

Example of the PEG Ratio

If you’re choosing between two stocks from companies in the same industry, then you may want to look at their PEG ratios to make your decision. For example, the stock of Company Y may trade for a price that’s 15 times its earnings, while Company Z’s stock may trade for 18 times its earnings. If you simply look at the P/E ratio, then Company Y may seem like the more appealing option.

However, Company Y has a projected five-year earnings growth rate of 12% per year while Company Z’s earnings have a projected growth rate of 19% per year for the same period. Here’s what their PEG ratio calculations would look like:

Company Y PEG = 15/12% = 1.25

Company Z PEG = 18/19% = 0.95

This shows that when you take possible growth into account, Company Z could be the better option because it’s actually trading for a discount compared to its value.